Sistem Informasi Layanan Pajak Daerah Pada Badan Pengelola Pajak Dan Retribusi Daerah

DOI:

https://doi.org/10.33998/jurnalmsi.2023.8.4.1514Abstrak

Badan Pengelola Pajak dan Retribusi Daerah (BPPRD) Muaro Jambi is the agency used in the management of local taxes and is responsible for the implementation of the regional taxation process in Muaro Jambi Regency. In carrying out the local taxation process starting from the data collection, registration, determination to local tax processes, human resources and technology are still needed to optimize local tax revenues. For now, the taxpayer's reporting process is still being reported manually. Because the submission of reports is still manual, taxpayers must come to the office of the Muaro Jambi Regional Tax and Retribution Management Agency and fill out the form available to be calculated by the tax officer, the tax assessment must be announced. The purpose of this study is to analyze and design a local tax service information system using an object-oriented model approach using UML (Unified Modeling Language) Use Case Diagrams, Class Diagrams, Activity Diagrams, and Databases. This study resulted in a solution to the problems that existed at BPPRD Muaro Jambi, namely in the form of a regional service information system design. In this designed system, it can manage taxpayer data (restaurants, hotels and parking), manage tax reporting data, manage tax reports, view taxpayer values, view taxpayer data, provide notifications to pay taxes, and as a medium of information from the Regency BPPRD. Muaro Jambi to taxpayers so that taxpayers do not need to commute to report their taxes so that taxpayers do not need to commute to report their taxes.

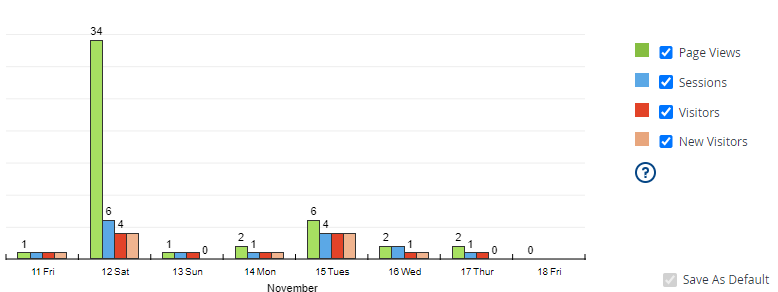

Unduhan

Referensi

Anonim. 2009. Undang-Undang Nomor 25 Tahun 2009 tentang Pelayanan Publik, Pelayanan Publik

Anonim. 2003. Menteri Pendayagunaan Aparatur Negara dalam keputusan No. 63 tahun 2003 Pedoman Umum Penyelenggaraan Pelayanan Publik

Anonim. 2009. Undang-Undang No 28 Tahun 2009 tentang Pajak Daerah dan Retribusi Daerah

Anonim. 2011. Peraturan Daerah No 6 Tahun 2011 tentang Pajak Daerah

Anonim. 2019. Peraturan Bupati No 29 Tahun 2019 tentang Pengelolaan Pajak Asli Daerah Kabupaten Muaro Jambi

Anonim. 2012. Peraturan Daerah No 01 Tahun 2013 tentang Pajak Hotel

Anonim. 2012. Peraturan Daerah No 02 Tahun 2013 tentang Pajak Restoran

Anonim. 2016. Peraturan Daerah No 18 Tahun 2016 tentang Pajak Parkir

Aziz, Hijrah dan Akib, Faisal. 2018. Analisis dan Perancangan Sistem Informasi Pengelolaan Pajak Daerah Berbasis Web (Studi Kasus ; Kantor DPPKAD Kota Palopo. Palopo

Dennis, Alan, Wixom, Barbara Haley, dan Roth, Roberta M. 2010, 2012. Systems Analysis And Design With UML. New Jersy : Person Education Inc.

Hutahean, Jeperson. 2014. Konsep Sistem Informasi. Yogyakarta : Budi Utama

Ibrahim, Wahyu Hidayat dan Maita Idria. 2017. Sistem Informasi Pelayanan Publik Berbasis Web Pada Dinas Pekerjaan Umum Kabupaten Kampar. Riau : Jurnal Ilmiah Rekayasa dan Manajemen Sistem Informasi

Laudon, C. Kenneth; Laudon, P. Jane. 2014. Management Information Systems Managing The Digital Firm, Thirteenth edition. Prentice Hall USA.

Pressman, Roger S. 2010. Software Engineering : A Practitioner’s Approach. Seventh Edition. New York : McGraw-Hill.

Purnamasari, Dewi. 2014. Analisis dan Perancangan Sistem Informasi Manajemen Pelayanan Pajak BPHTB di DPPKAD Kota Tangerang Selatan. Tangerang Selatan

Purnomo, Arif. 2020. Analisis dan Perancangan Sistem Infromasi Layanan Pajak Daerah pada Badan Pengelola Pajak Daerah dan Retribusi Daerah Kota Jambi. Kota Jambi

Rosa, Shalahuddin. 2014. Rekayasa Perangkat Lunak Terstruktur dan Berorientasi Objek.Bandung : Informatika

Sandiasa, Gede dan Agustana, Putu. 2018. Reformasi Administasi dan Birokrasi Pemerintahan Derah Dalam Meningkatkan Kulitas Layanan Publik di Daerah. Bali. Jurnal Amdinistasi Publik

Whitten, Jeffrey L dan Bentley, Lonnie D. 2007. Systems Analysis and Design Methods. New York : McGraw-Hill.