Efektivitas Teknologi Financial (Fintech) dalam Mendukung Akses Keuangan Bagi Pelaku UMKM Di Kalangan Generasi Milenial

DOI:

https://doi.org/10.33998/jms.2025.5.2.2534Keywords:

Financial Literacy, Financial Technology, Gender, Financial Behavior, Millennial GenerationAbstract

This study examines the influence of financial literacy, financial technology (FinTech), and demographic moderation on the financial behavior of the Millennial generation in Indonesia. Employing a descriptive quantitative approach and the Structural Equation Modeling (SEM) method based on Partial Least Squares (PLS), data were collected from 97 respondents using a structured questionnaire. The analysis results reveal that financial literacy (X1), FinTech (X2), and demographic moderation (Z) have a significant impact on financial behavior (Y). Financial literacy directly enhances individuals’ ability to manage finances, invest, and plan for their financial future, with a P-value of 0.004. FinTech also promotes more efficient financial behavior, with a P-value of 0.009. Furthermore, demographic moderation significantly moderates the relationship between financial literacy and FinTech with financial behavior, with P-values of 0.002 and 0.035, respectively. These findings highlight the importance of incorporating demographic perspectives in understanding Millennials’ financial behavior. The research model demonstrates strong predictive capability, with an R-Square value of 0.766, indicating that 76.6% of the variance in financial behavior is explained by the independent variables. The constructs’ reliability and validity were well established, as evidenced by Cronbach’s Alpha and Composite Reliability values above 0.7, as well as an Average Variance Extracted (AVE) exceeding 0.5. Theoretically, this study contributes to the understanding of the relationship between financial literacy, FinTech, and demographic factors in shaping financial behavior. Practically, the findings suggest that FinTech service providers should design more inclusive strategies and implement effective financial education programs for Millennials. A comprehensive approach that considers demographic and technological factors is essential for enhancing financial literacy and behavior more effectively.

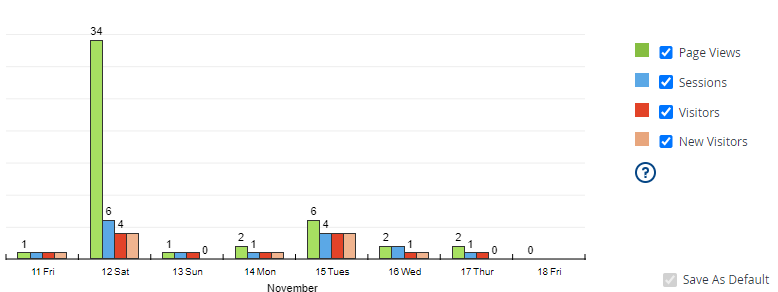

Downloads

References

L. Qoriah, I. Safitri, L. Husna, N. Chifdzi, and L. Nisak, “Peran Fintech dalam Mendorong Transaksi Berkelanjutan dan Investasi Hijau Global,” CEMERLANG J. Manaj. dan Ekon. Bisnis, vol. 5, no. 1, pp. 80–90, 2025, doi: 10.55606/cemerlang.v5i1.3436.

N. Kristi, D. F. Shiddieq, and D. Nurhayati, “Analisis Penerimaan Aplikasi Flip Menggunakan Model Unified of Acceptance and Use of Technology 3,” MALCOM Indones. J. Mach. Learn. Comput. Sci., vol. 4, no. 2, pp. 685–694, 2024, doi: 10.57152/malcom.v4i2.1316.

A. M. Mendes, F. W. Ballo, and M. I. H. Tiwu, “Pengaruh Literasi Keuangan Dan Financial Technology Terhadap UMKM Di Kabupaten Malaka Kota Betun,” J. Ekon. dan Pembang. Indones., vol. 2, no. 2, pp. 39–51, 2024, doi: 10.61132/jepi.v2i2.516.

P. Aulia, W. Asisa, N. Dalianti, and Y. R. Handa, “Pengaruh Pemahaman Literasi Keuangan dan Kemudahan Digital Payment Terhadap Kinerja UMKM di Kota Makassar,” J. Din., vol. 3, no. 1, pp. 23–50, 2022, doi: 10.18326/dinamika.v3i1.23-50.

D. Arner, J. Barberis, and R. Buckley, “The Evolution of FinTech: A New Post-Crisis Paradigm,” 62, 2016. doi: 10.2139/ssrn.2676553.

U. Azizah and A. Akbar, “Studi Komparasi Volume Penjualan dan Pendapatan Produk Selis (Sepeda Listrik) Di Shopee & Tokopedia,” J. Educ. Dev. Inst. Pendidik. Tapanuli Selatan, vol. 12, no. 1, p. 258, 2024, doi: 10.37081/ed.v12i1.5375.

M. Z. Arif, F. D. Anto, S. Rahayu, and N. Karima, “Analisis Efektivitas Penggunaan Fintech Terhadap Pendapatan UMKM di Tulungagung,” Transform. J. Econ. Bus. Manag., vol. 3, no. 3, pp. 96–104, 2024, doi: 10.56444/transformasi.v3i3.1957.

R. Basalamah, N. Nurdin, A. Haekal, N. Noval, and A. Jalil, “Pengaruh Persepsi Kemudahan dan Risiko Terhadap Minat Menggunakan Financial Technology (Fintech) Gopay Pada Generasi Milenial Di Kota Palu,” J. Ilmu Ekon. dan Bisnis Islam, vol. 4, no. 1, pp. 57–71, 2022, doi: 10.24239/jiebi.v4i1.93.57-71.

O. Feriyanto, Z. Qur’anisa, M. Herawati, Lisvi, and M. H. Putri, “Peran Fintech Dalam Meningkatkan Akses Keuangan Di Era Digital,” GEMILANG J. Manaj. dan Akunt., vol. 4, no. 3, pp. 99–114, 2024, doi: 10.56910/gemilang.v4i3.1573.

R. P. Akbar and R. F. Armansyah, “Perilaku Keuangan Generasi Z Berdasarkan Literasi,” J. Ilm. Manaj. dan Bisnis, vol. 2, no. 2, pp. 107–124, 2023, doi: 10.24034/jimbis.v2i2.5836.

Z. Zulkarnaini, “Analisa Faktor Tingkat Keberhasilan Digital Marketing Lewat Media Sosial Facebook,” STIE Indonesia Jakarta, 2021.

H. Fath, S. Kholijah, F. E. Syariah, U. Stai, and D. Lampung, “The Role of Sharia Financial Technology (Fintech) in the UMKM Economy (Case Study on UMKM West Java),” COSTING J. Econ. Bus. Account., vol. 7, no. 6, pp. 8592–8605, 2024.

R. R. Suryono, “Financial Technology (Fintech) Dalam Perspektif Aksiologi,” Masy. Telemat. Dan Inf. J. Penelit. Teknol. Inf. dan Komun., vol. 10, no. 1, p. 52, 2019, doi: 10.17933/mti.v10i1.138.

J. Pelawi and R. Suliati, “Analisis Faktor-Faktor yang Mempengaruhi Minat Investasi Individu Di Pasar Modal Saham Di Tengah Pandemi Covid-19,” J. Syntax Imp. J. Ilmu Sos. dan Pendidik., vol. 2, no. 5, p. 350, 2021, doi: 10.36418/syntax-imperatif.v2i5.115.

Sugiyono, Metode Penelitian dan Pengembangan Research and Development/R&D. Bandung: Alfabeta, 2015.

S. Lemeshow, D. W. Hosmer, J. Klar, and S. K. Lwanga, Adequacy of Sample Size in Health Studies. Geneva: World Health Organization, 1990.

D. A. P. Andiani and R. Maria, “Pengaruh Financial Technology dan Literasi Keuangan terhadap Perilaku Keuangan pada Generasi Z,” J. Akunt. Bisnis dan Ekon., vol. 9, no. 2, pp. 3468–3475, 2023, doi: 10.33197/jabe.vol9.iss2.2023.1226.

A. I. Lestari, N. A. Simanungkalit, and R. Sanjaya, “Pengaruh Financial Tecnology terhadap Manajemen Keuangan Generasi Z,” Ris. Ilmu Manaj. Bisnis dan Akunt., vol. 2, no. 4, pp. 82–89, 2024, doi: 10.61132/rimba.v2i4.1331.

U. W. Saputra, “Role of user experience towards customer loyalty with mediating role of customer satisfaction at Shopee,” Rev. Manag. Accounting, Bus. Stud., vol. 2, no. 2, pp. 104–113, 2021, doi: 10.38043/revenue.v2i2.4050.

N. S. Azizah, “Pengaruh Literasi Keuangan, Gaya Hidup pada Perilaku Keuangan pada Generasi Milenial,” Prism. (Platform Ris. Mhs. Akuntansi), vol. 01, no. 02, pp. 92–101, 2020, doi: 10.1558/ecotheology.v9i1.124.

E. Novianta, A. Andani, . F., and S. G. Pane, “Financial Technology Dan Literasi Keuangan Terhadap Generasi Z,” J. Ekon. Dan Bisnis, vol. 4, no. 1, pp. 1–8, 2024, doi: 10.47233/jebs.v4i1.1423.